The Future of

Sustainable Finance

and Green Economies

in the MENA Region

The Role of Sustainability

in Driving Growth and Development

Introduction

There can be little doubt that the world is moving towards the end of the hydrocarbon era, though the pace and nature of the energy transition are still playing out. From a climate perspective, the transition cannot happen soon enough. While the weight of global public opinion seems in favour of rapid, almost overnight, change, the mechanics of bringing about that change will be both timely and complex.

Hydrocarbon consuming and producing countries are introducing and implementing a range of policies to cut greenhouse gas (GHG) emissions in line with Net Zero commitments made at successive Conference of Parties (COP) Summits, while making considerable efforts to ‘green’ their economies . Naturally, the approaches to cutting emissions differ between producing and consuming countries, especially when the former economies are highly dependent upon hydrocarbon revenues. Despite efforts to diversify, Gulf Arab state economies remain reliant upon exports of oil and gas and this will continue to be the main source of revenue for decades to come.

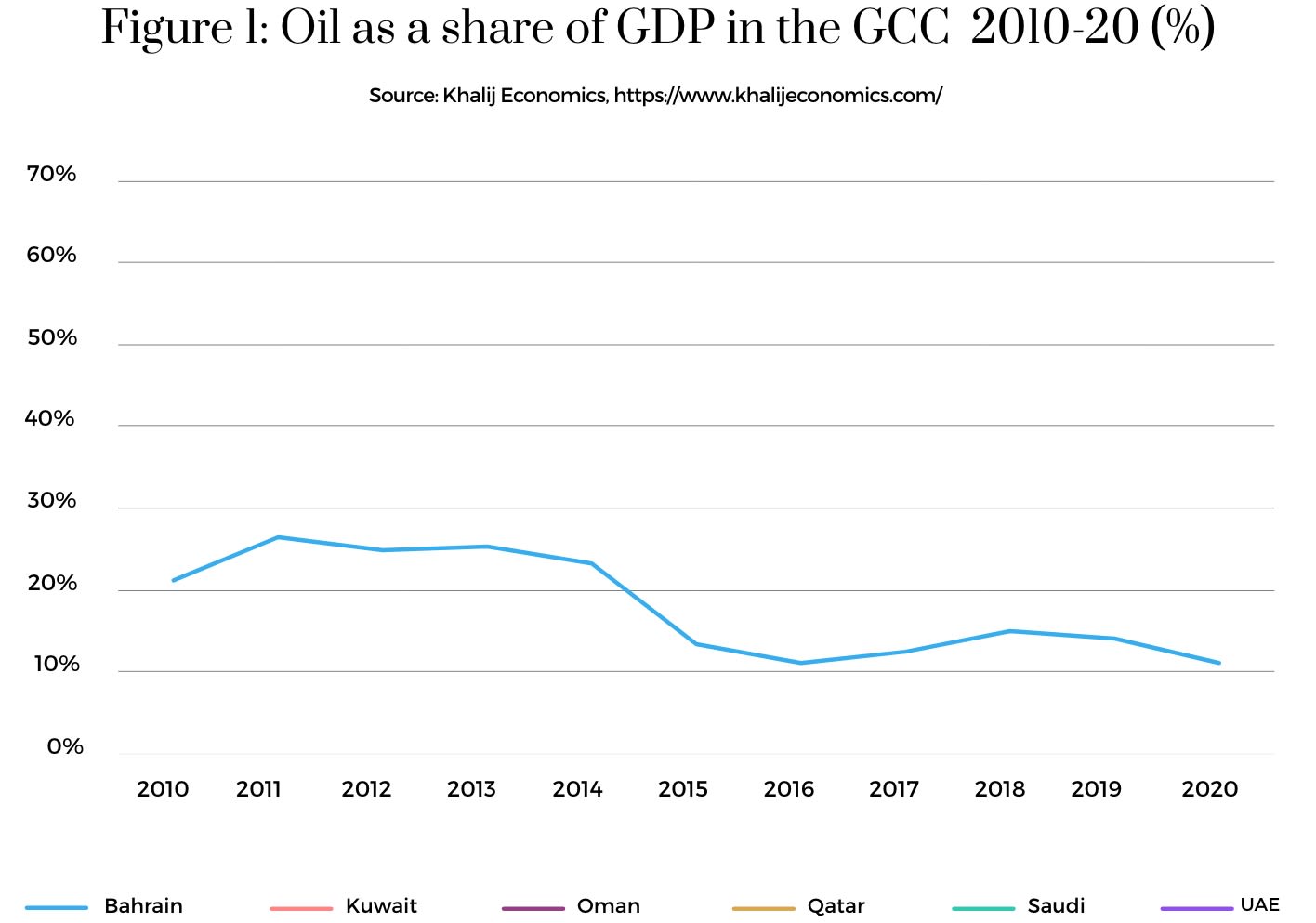

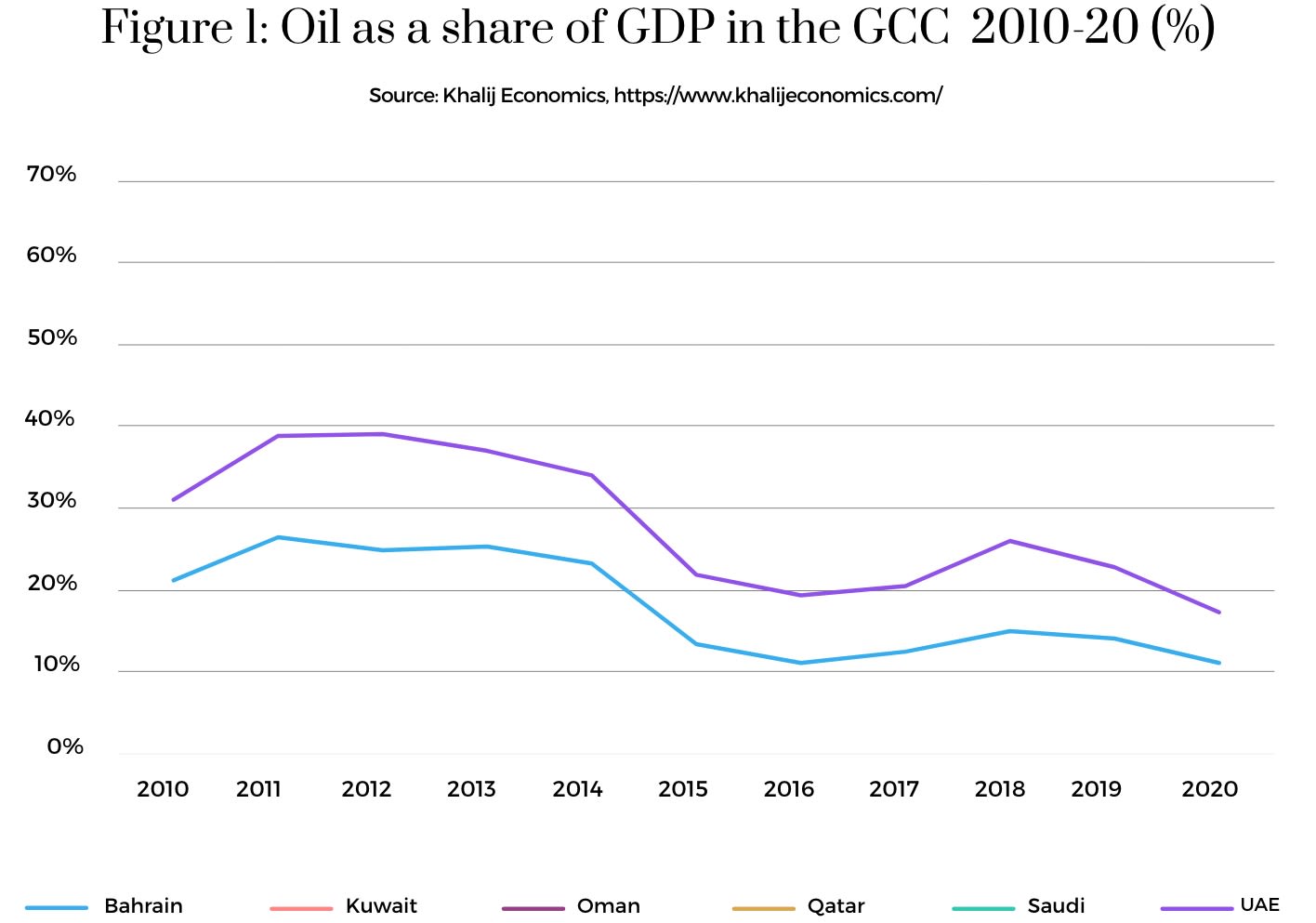

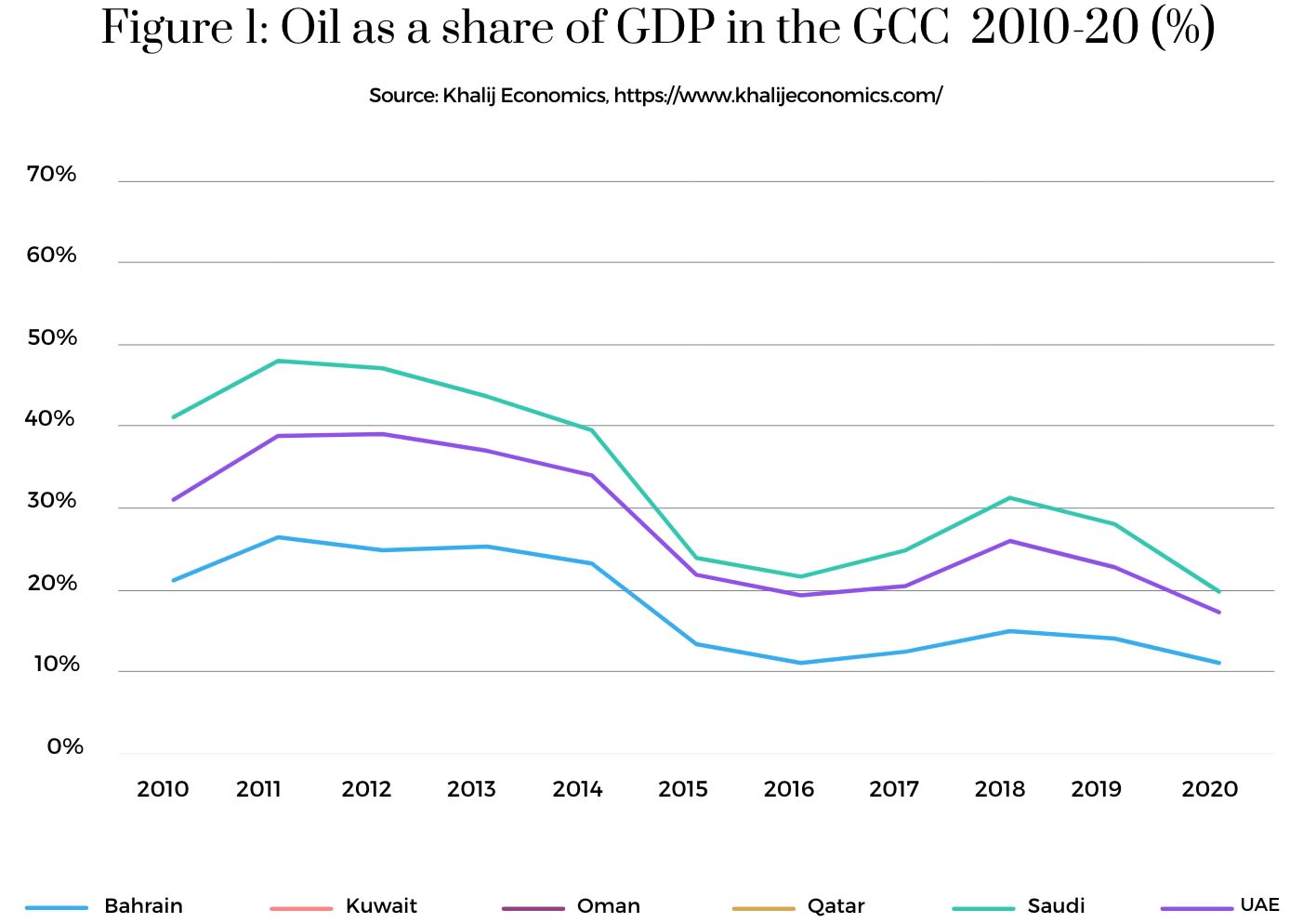

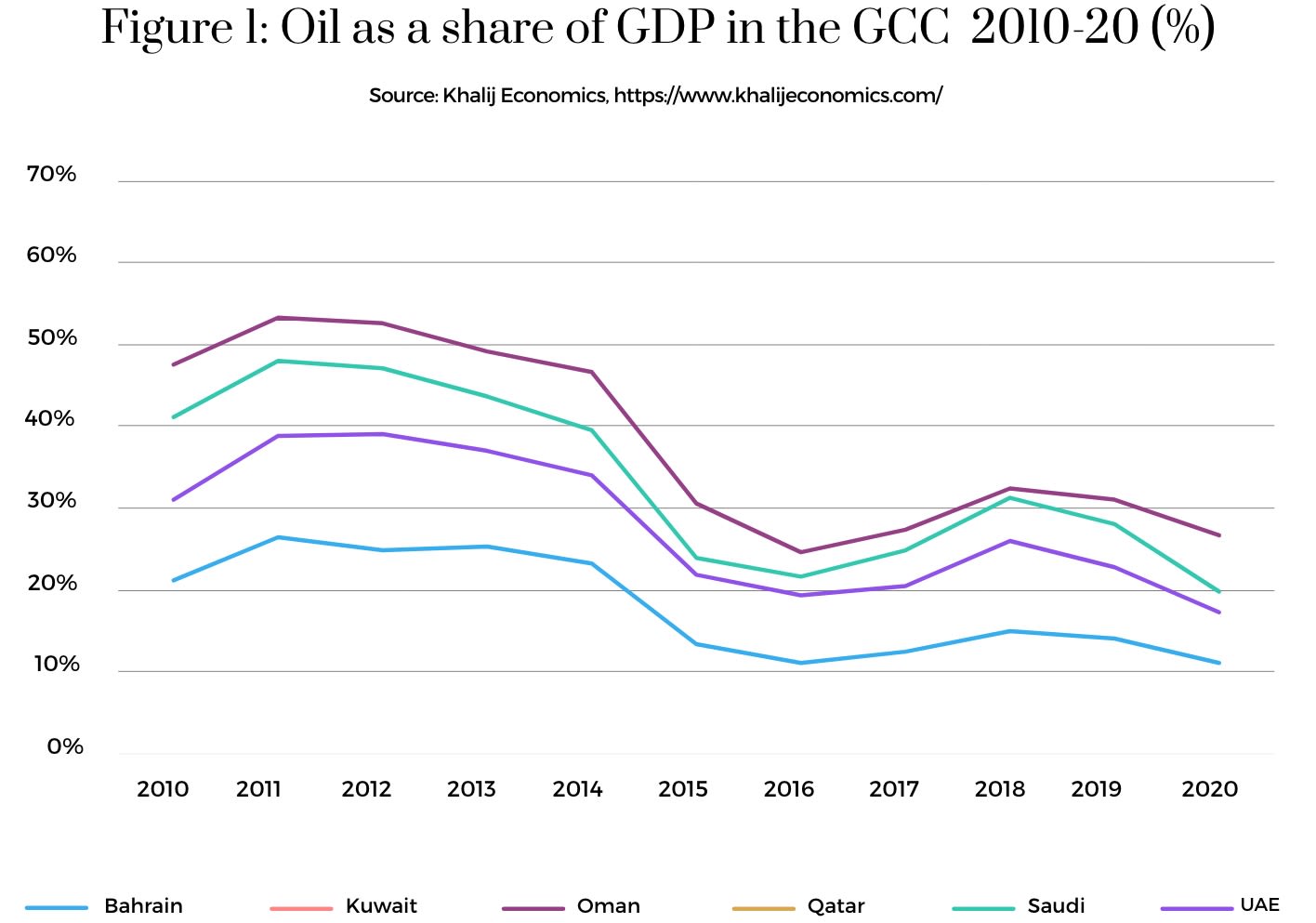

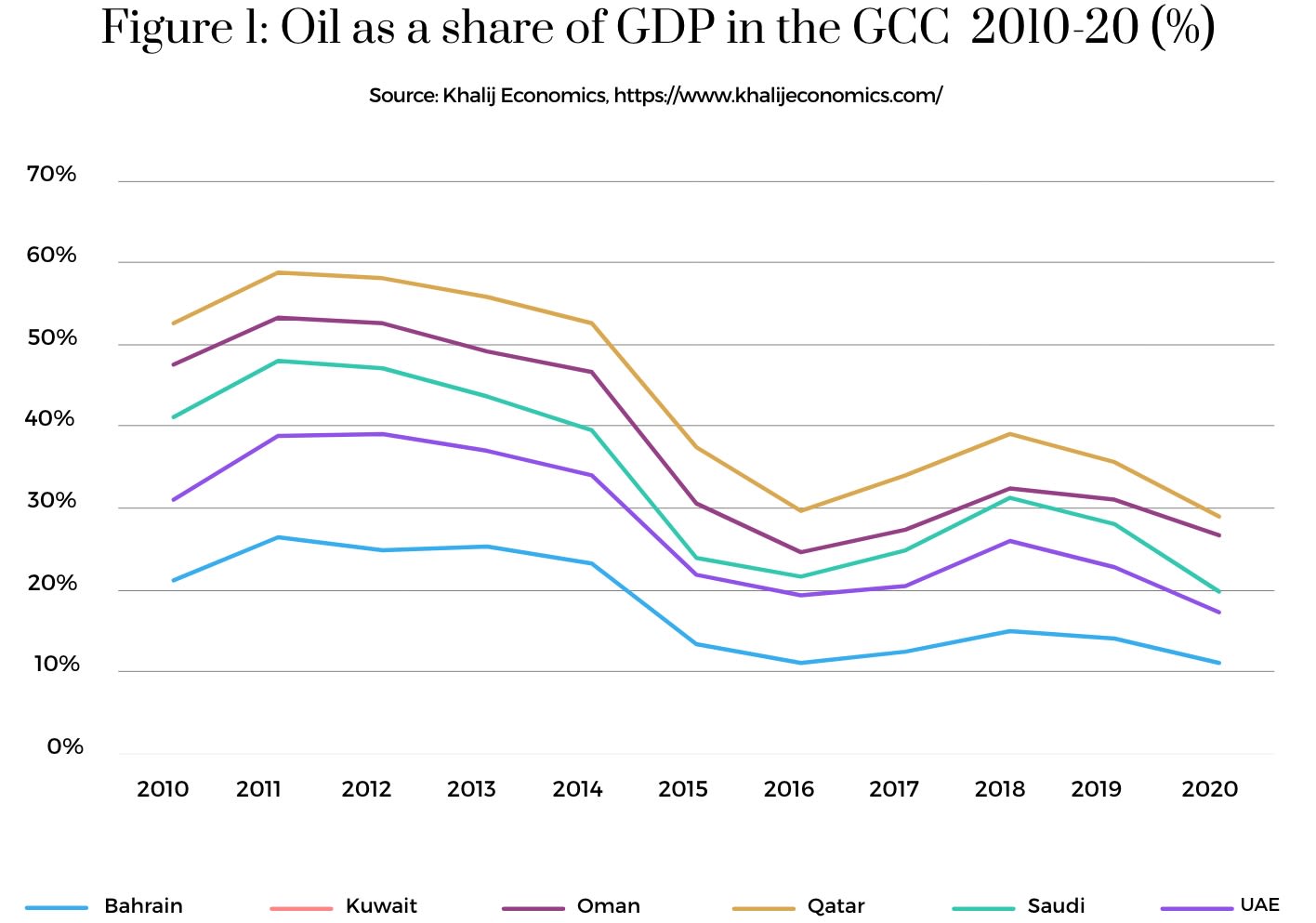

Over the past decade, the Gulf Arab states have taken several steps to not only diversify their economies, as reflected in Figure 1, but also to green them. These have included policies and interventions to support the adoption of sustainable infrastructure throughout the region; creation of an enabling environment to encourage sustainable finance; and, of course, the deployment of renewables, which is detailed in our Leapfrogging to Renewable Energy report. Other states in the region, such as Egypt, Jordan and Morocco, have followed a similar course too, though perhaps with less fanfare.

Saudi Arabia and the United Arab Emirates (UAE) have established high-profile flagship projects, including NEOM and Masdar, which are intended to showcase their commitment to greening the future while simultaneously highlighting their ambitions to leapfrog older industrial economies - which continue to need hydrocarbons. While wealthier Gulf Arab states might be better positioned to hasten the pace of their energy transitions given natural advantages such as extended hours of sunlight; small population size; considerable sovereign wealth funds (SWFs) and an ability to introduce necessary but unpopular policies and measures with little resistance, they will continue to be restrained by reliance upon oil and gas exports.

This report provides a snapshot of Gulf Arab states’, Egyptian, Jordanian and Moroccan efforts at greening their economies. This selection of countries has been determined by the availability of data and not deliberate exclusion.

As noted below, definitions of a green economy remain fluid and can often change, according to the particulars of each given context. At best, it is an all-encompassing concept and pervades essential aspects of a country’s economy. Countries and regions have differing definitions of “green economies” as well as various elements that have been included under their green economy strategies. SRMG THINK has conducted an extensive review of the strategies launched in the countries covered in this report. We have concluded the most efficient and accurate way to define “green economies” is through looking at two key components: sustainable finance and sustainable infrastructure.

Section one: Green economies

The United Nations Environment Programme (UNEP) defines a green economy as low carbon, resource efficient and socially inclusive. It generates prosperity while maintaining the natural systems that sustain humanity , moving away from production and consumption behaviours that disproportionately burden the environment. The concept has been adopted as a strategic priority for governments and organisations around the world, as leaders – and societies – recognise that current economic systems and processes are incompatible with long-term development goals.

The green economy agenda straddles environment and economy and sits in tandem with sustainable development. It focuses on using targeted public expenditure, policy reforms, and changes to taxation and regulations to support green investment which, in turn, enables sustainable economic growth. Hence, the terms green and sustainable are often used interchangeably by policymakers, analysts and practitioners.

There are multiple definitions of and frameworks for a green economy; however, it is broadly agreed that a green economy prioritises the development of economic activities, infrastructure, and assets – through both public and private investment – that enables lower carbon emissions and pollution; greater energy and resource efficiency; and the preservation of biodiversity and ecosystems to ensure that natural capital remains in place for future generations . There is also consensus that green economies emphasise skills, employment, and the positive social impact of the environment, as well as the importance of people’s well-being.

SRMG THINK has focused on two key elements of green economies: finance and infrastructure. Greening economies require significant capital to finance technological developments, such as smart electrical grids, renewable energy sources, electrification of transport and resource-efficient buildings. These economies also require an innovative approach to develop new, and to adapt existing, infrastructure to serve the changing needs of societies. As noted above, Gulf Arab states are suitably positioned to green their economies and manage energy transition, but the pace and sequencing of both processes will be critical to achieving success. One area in which they have begun to make progress is sustainable finance.

Section two: Sustainable finance

Green bonds are a key facet of sustainable finance. They fund projects that support energy development, sustainable resource management, clean transport and climate change adaptation. They also finance projects linked to biodiversity conservation and pollution prevention or mitigation. Investors looking to improve their environmental credentials can purchase these bonds with the proceeds tied directly to specific green or social projects.

Similar types of green bonds and loans include sustainability linked bonds (SLBs), green loans and sustainability linked loans (SLLs). SLBs are aimed at sustainable practices, and their proceeds are directed to general corporate capacity for achieving climate or sustainability goals rather than being earmarked for specific sustainability linked projects. SLBs are also a combination of social and green bonds, with social bond proceeds financing projects that directly address specific social issues or advance social causes.

SLLs are pro-ESG debt mechanisms where the loan is granted with the aim of incentivising the borrower to improve its sustainable practices. These loans are tied to sustainability performance targets (SPTs), which are determined at the outset by the lender and borrower. The borrower’s sustainability performance is measured over the course of the loan with interest rates reducing if the borrower’s predetermined SPTs are met or if their ESG rating improves.

While green bonds, green loans, SLBs and SLLs have taken off globally, this sector is still relatively new and requires additional development and regulation. There is need for greater transparency for investors in ensuring that the funds are utilised for green projects. The success rate and actual impact of green and social schemes are also under question. A final constraint is setting clearly defined and meaningful SPTs and designing an accurate metric for their success and implementation, which is examined via external review. However, this process remains a work in progress and parties have yet to reach meaningful consensus.

Since the European Investment Bank issued the first green bond in 2007, valued at $807 million, the green bond market has expanded; it was estimated to be worth $1.1 trillion by the end of 2021. Nearly 1500 issuers were registered at the end of 2021, a 50% increase on end-2020, at which point the market was valued at only $290 billion. This exponential growth demonstrates significant investor and corporate interest in supporting ESG-friendly initiatives.

Sustainable finance in the Middle East and North Africa (MENA)

Interest in green investment and financing across the Middle East region is growing in line with global trends. Its success, however, will be dependent on the fostering of an enabling environment; this will be shaped by factors such as national sustainability pledges, finance strategies, reporting standards, financial disclosure of climate risk standards, and standards for sustainable investment products.

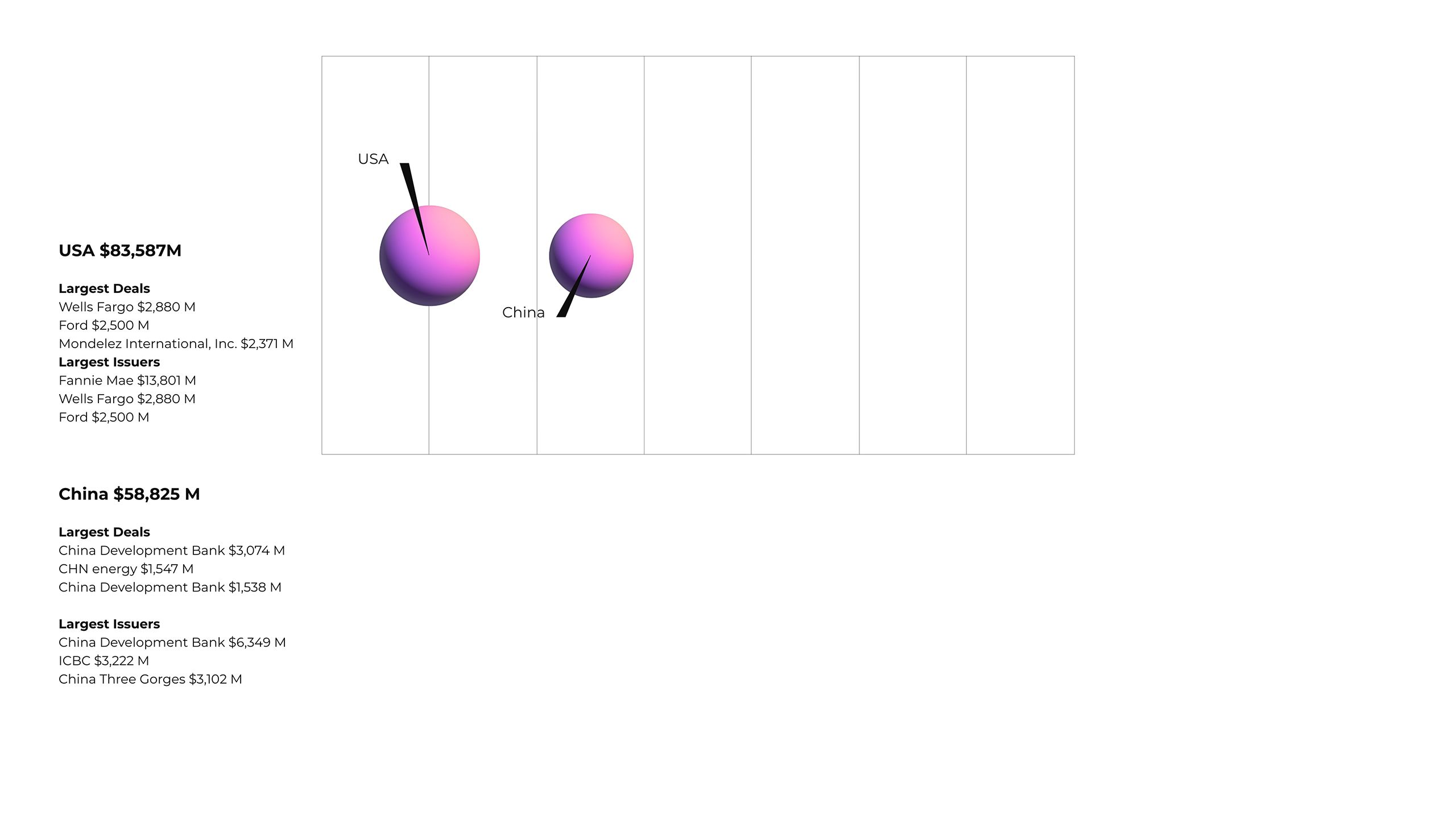

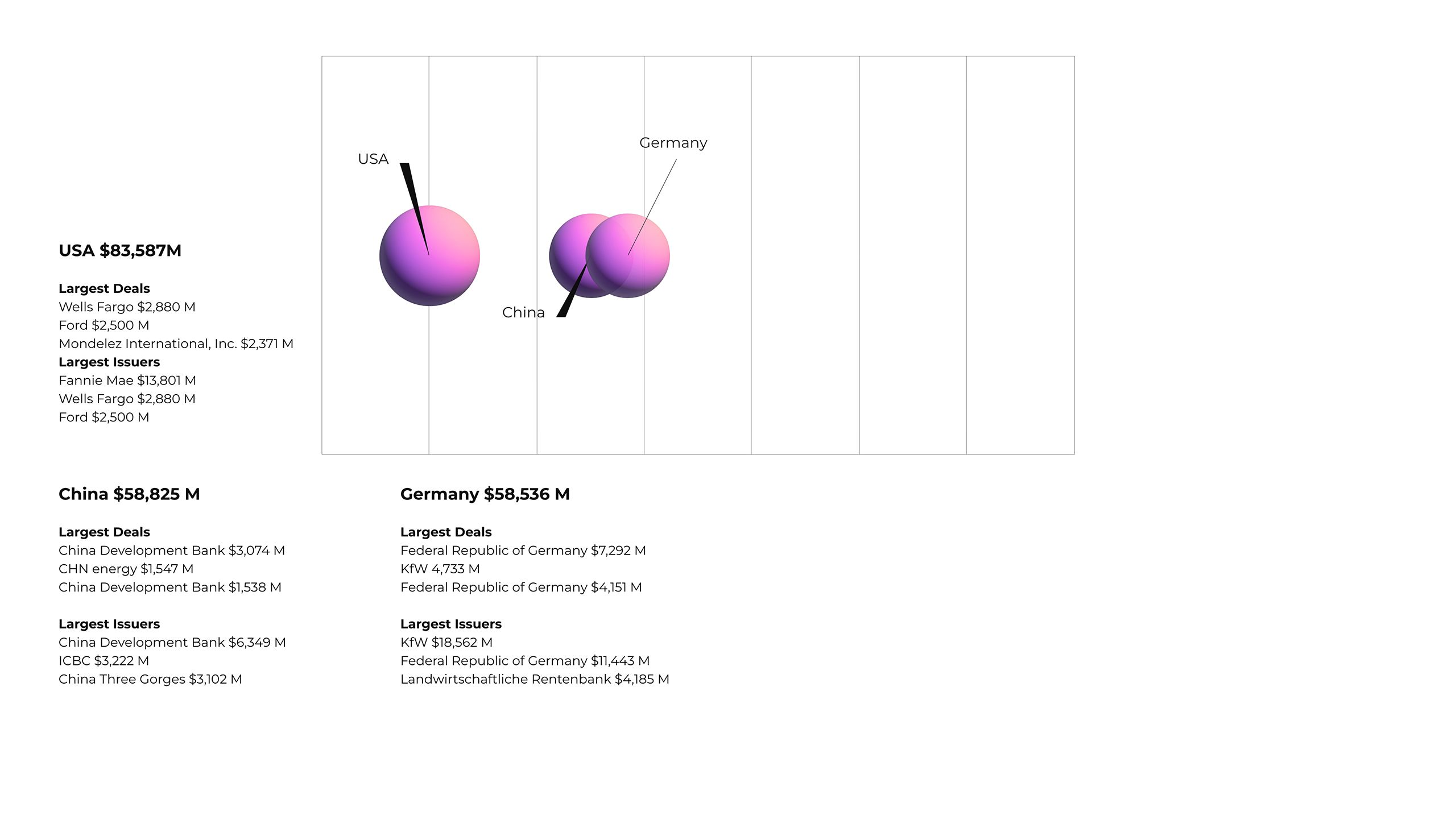

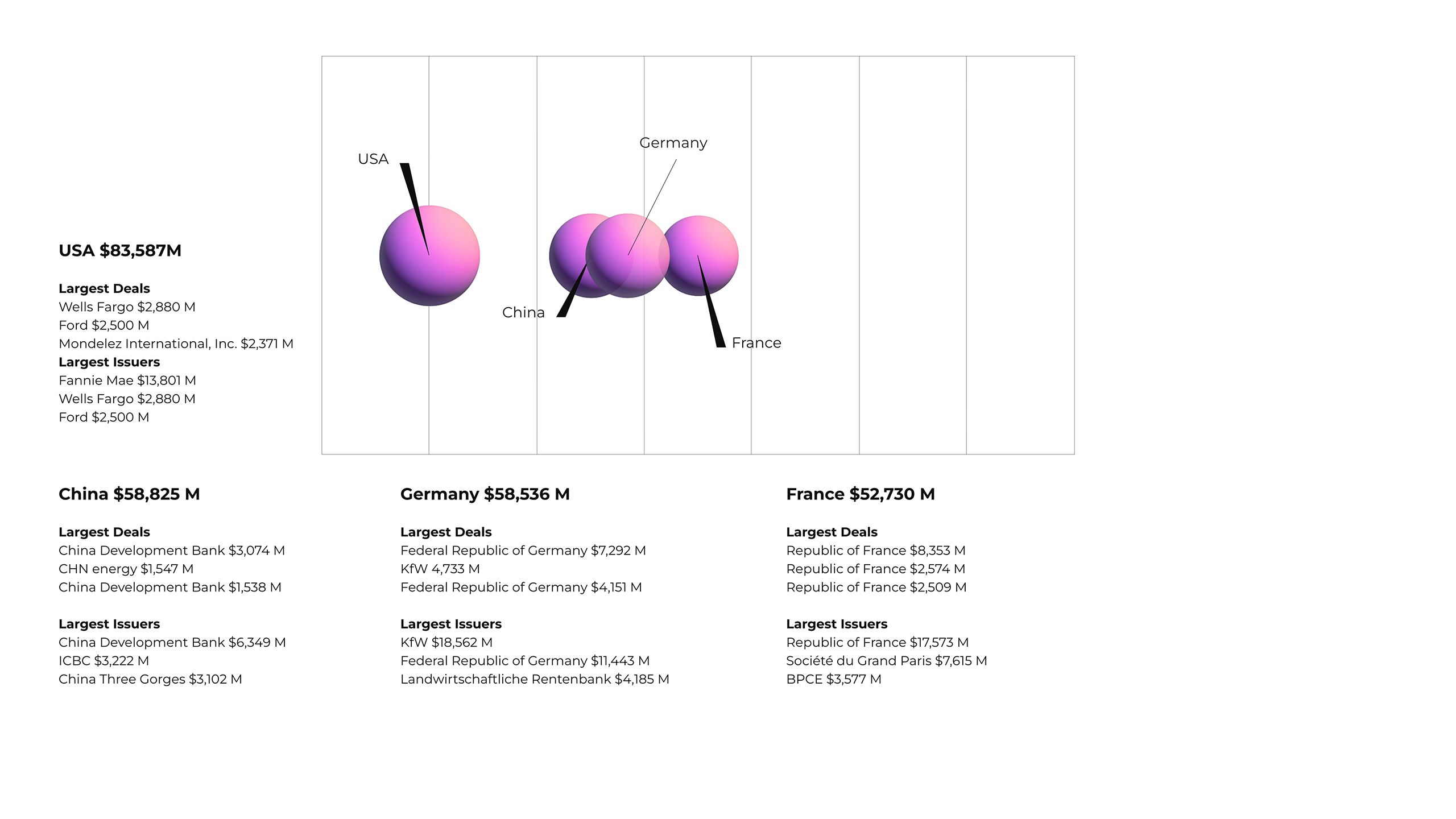

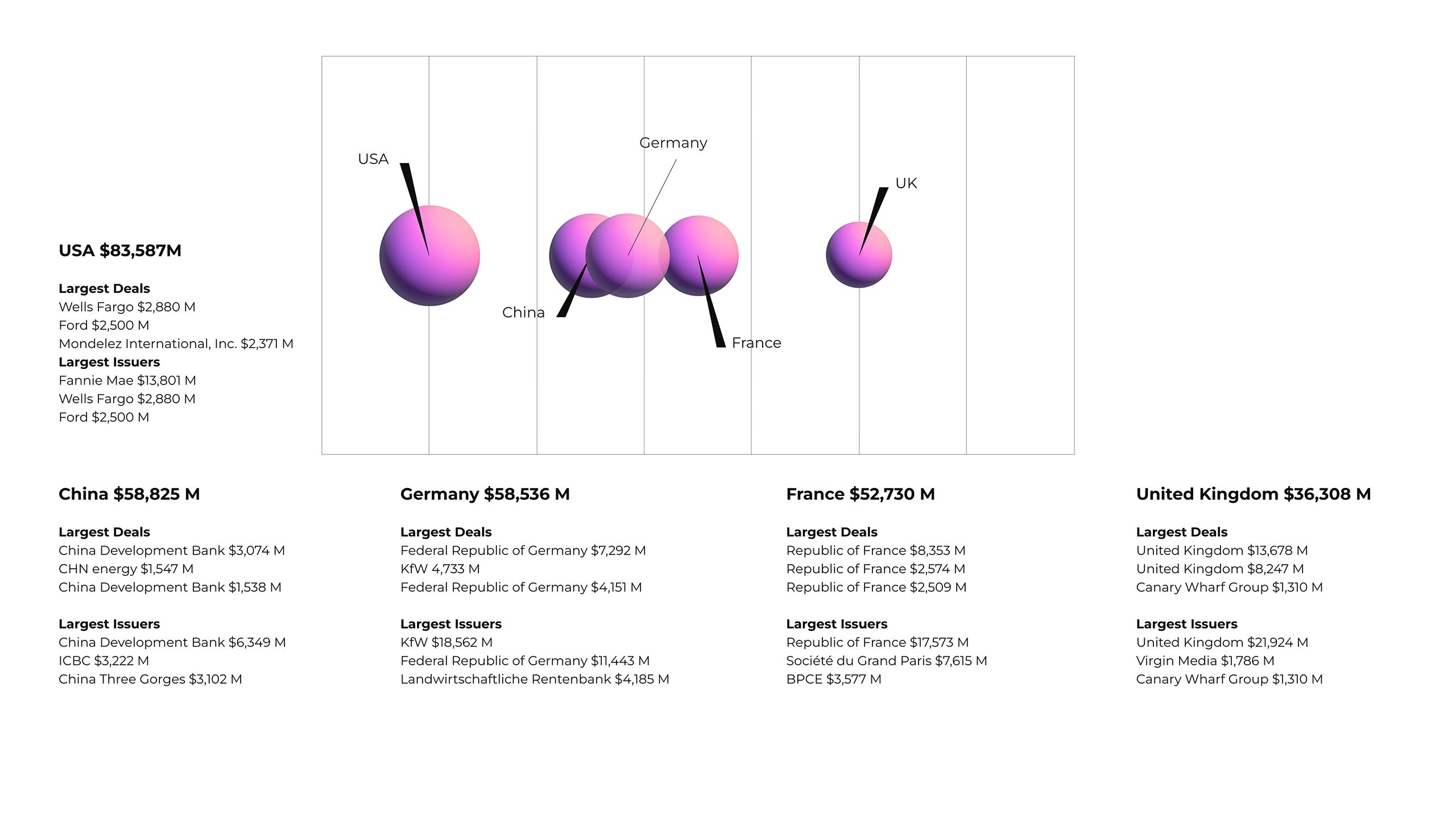

Growth in sustainable finance in the MENA region in recent years has been impressive, as this report details below. However, Figure 2 illustrates the extent to which sustainable finance in countries such as the US, China, Germany and France has advanced, in comparison to which the Gulf region lags behind. For example, in 2021, France issued $52,730m in sustainable bonds compared to the GCC region’s $10,030m. The largest deal in Germany was valued at $7,292m, where the largest deal in the GCC was worth $2,500m.

Figure 2: Global sustainable bond issuance 2021 (billion US$)

Source: Environmental Finance, Sustainable Bonds Insight 2022; and Environmental Finance Data, https://efdata.org/

Table 1 provides an overview of the sustainable finance environment in the MENA region. It points to positive developments; however, more can be done when it comes to countries’ approaches to sustainable finance. For example, while all countries, except Egypt, have pledged sustainability targets, only the UAE, Egypt and Morocco have established Green Finance Strategies. It is notable that all countries, except Oman, have instituted corporate sustainability standards (GRI), and yet none have instituted financial disclosure of climate risks standards (TCFD), though this is under development in Egypt.

The institutional frameworks and processes which have enabled other regions to fast-track sustainable finance in a short period of time could be more robust and consistent in MENA. However, a closer inspection of bond and loan issuances over the past few years shows a growing appetite among public and private investors and if states are able to meet this with the necessary frameworks and regulations, a wider-scale movement into green investments is likely.

Sustainable bonds

The Gulf region issued its first green bonds in 2017 and it remains an underdeveloped market. Only one sovereign green bond has been issued in the MENA region - by Egypt in 2020, valued at $750m - and bond issuances, to date, remain the almost exclusive preserve of financial institutions. The market has yet to reach a point of maturity where issuers come from a wide range of participants such as sovereign, supranational, municipal, financial institution, agency and corporations.

The value of green bond issuing markets in the Gulf Arab states is small compared to the major players, which have engaged in the market since 2007. For example, Figure 7 shows that the value of bond issuances during 2021 in the US was $83,587m, Germany $58,336m and the Gulf Arab states $9,896m.

However, issuances from the Gulf Arab states have increased substantially from $587m in 2017 to $9,821m in 2021. The market has grown nearly 16-fold in the space of three years.

Figure 3: Green bond issuing markets, 2021 (US$ million)

Green bonds dominated the Middle East market until SLBs first appeared in 2020. During that year, green bonds were issued at a value of $1,996m and SLBs issued at $1,350m. However, in 2021, SLBs outvalued green bonds at $7,509m compared to $2,311m. While the bond market experienced overall growth in 2021, SLBs outvalued green bonds three-fold. It is too early to appreciate the factors behind the growing spread, but the most likely explanation is that green bonds are required to directly finance climate or green projects, whereas SLBs can be used for wider purposes. Unlike green bonds, SLBs target a wider investor base and have financial or structural characteristics that vary depending on whether the issuer meets certain pre-defined key performance indicators (KPIs), which are assessed against certain sustainability performance targets (SPTs). SLBs may be used for application in a general corporate setting or for other purposes; therefore, the Use of Proceeds (UoP) is not a determinant in its categorisation as an SLB. If an SLB is issued, the issuer will be committing to improvements in the sustainability outcomes of its business within a pre-agreed timeline. As such, SLBs are forward-looking, performance-based instruments and though sustainability-linked, they can be characterised as ‘green-lite’.

Figure 5: MENA green bonds by type of issuer, 2018-22 (%)

Given that the bond market in the MENA region is still evolving, it is unsurprising that there are fewer types of bond issuers than in more mature markets. Global bond markets were previously dominated by financial institutions and municipal governments, but there has been a discernible shift towards supranationals and corporations, which now comprise approximately two-thirds of the market. Sovereign issuers have also become important participants since 2020 and now comprise 10% of the market. In the MENA region, corporate issuers are the biggest players, comprising 38% of bond issuance, followed by financial institutions (29%). The composition of issuers will likely follow global trends, if regional governments develop a more enabling environment and efforts to green economies are tied to specific green projects.

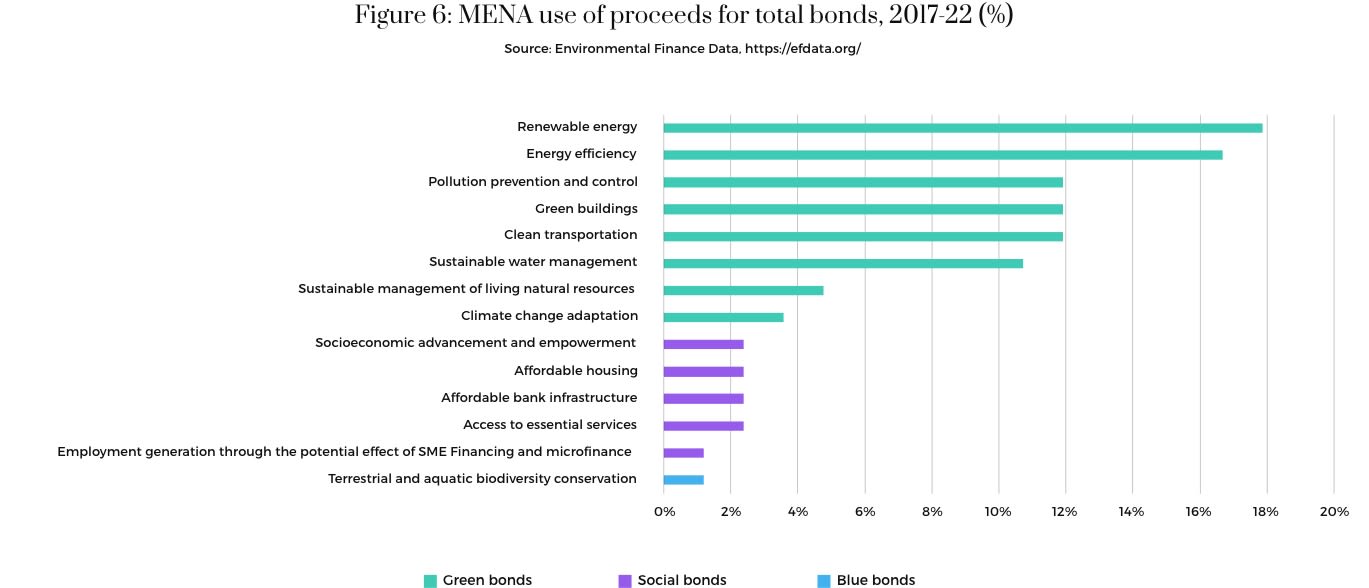

Issuers of bonds agree to allocate funds raised to finance or refinance eligible projects or assets according to specific categories. Sustainable bond UoPs are often categorised as green, social or blue. Green bonds are committed to environmental or climate projects, such as investing in renewable energy. Social bonds are committed to social impact projects, such as investing in low-cost housing. Blue bonds are committed to marine or water projects, such as investing in the transition to sustainable fish stock. Finally, sustainability bonds are committed to a mix of social and green impact projects. These projects are often aligned with the UN Sustainable Development Goals (SDGs).

Figure 6 gives a very clear indication that UoPs in total bonds issued since 2017 have been committed to all four categories, but mostly concentrated in environmental and climate projects (89%) in the form of renewables, energy efficiency and pollution prevention and control. Social bond UoPs - which include projects in socioeconomic advancement and empowerment; access to essential services; affordable housing; affordable bank infrastructure; and employment generation through the potential effect of SME financing and microfinance - amount to an 11% spread, while blue and sustainability bond UoPs score just a meager 1%.

Sustainable loans

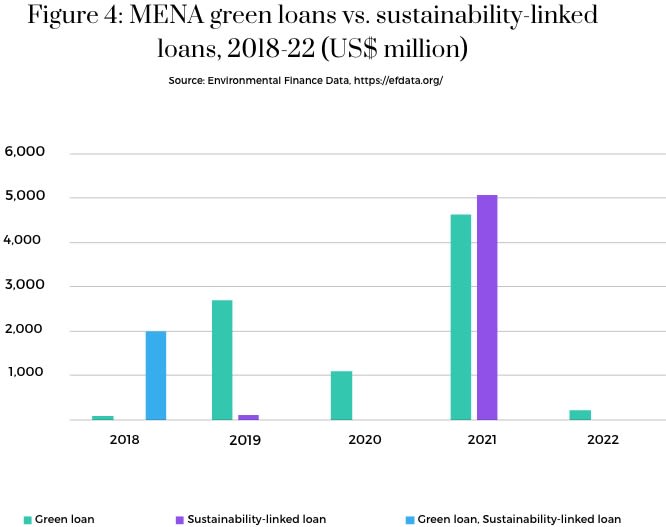

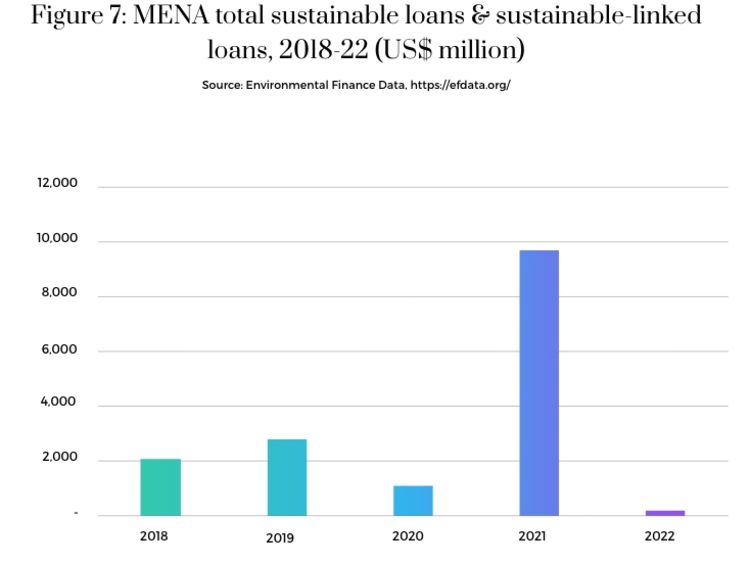

The Gulf region issued its first sustainable loan in 2018. The value of sustainable loans grew from $2,075m in 2018 to $2,690m in 2019 before dropping to $1,092m in 2020 and hitting a high of $9,706m in 2021. The growth in sustainable loans was five-fold between 2017-2021 and gives a clear indication that the market for sustainable finance is expanding at pace. While the volume of growth lags far behind that of other regions, the speed of growth is accelerating, and MENA governments are also moving quickly to enhance their sustainable finance architecture.

Figure 8 shows that the spread among sustainable loans follows the same trend as sustainability bonds in that the value of SLL growth has started to outpace green loans. However, the increase did not become apparent until 2021, after SLLs had made a very modest debut in 2019, retreated in 2020 in line with green loans – in response to the global pandemic – and then burst on to the scene. There have been no recorded SLLs in 2022 to date, and so it is difficult to determine the overall trend. Nevertheless, given that SLLs share the same wide spectrum as SLBs, they are likely to outpace green loans over the next few years.

Green loan borrowers between 2018-2022 came from 10 sectors and the three most significant according to value were financial (18%), renewable (17%), and real estate (17%). It is notable that non-renewable energy, public transportation and utilities represented 9% each.

Figure 10: MENA use of proceeds for green loans, 2018-22 (%)

Figure 9: MENA green loans by sector, 2018-22 (%)

Sustainable loan UoPs operate in the same way as sustainable bond UoPs. The proceeds of a green loan must be applied for green projects. All designated green projects should provide clear environmental benefits which are assessed, quantified, measured and reported. SSLs, however, incentivise borrowers to improve sustainability over the term of the loan by achieving pre-agreed ESG-related KPIs.

Figure 10, which details the UoPs for green loans between 2018-22, shows clearly that green buildings and renewable energy projects were the largest beneficiary of loans (75%), while sustainable water management, biodiversity conservation and clean transport received 8% each.

Section three: Sustainable infrastructure

When looking at the definition of sustainable infrastructure and green infrastructure its clear the definitions of the concept of sustainable infrastructure is universally applicable, while that of green infrastructure has been conceived in temperate climates where rivers, streams, and canals are commonplace, rather than in harsh arid environments. Nevertheless, this report uses both terms interchangeably, recognising that MENA governments have shown a clear ambition to create green infrastructure in new and rapidly developing cities. As such, green infrastructure is considered a vital component of planning policies, particularly as governments work to realise their commitments under international frameworks, such as COP26 and the Paris Agreement. Shifts in public policy and private investment decisions help ensure that climate resilience and environmental considerations are accepted and are critical factors in developing all sectors of the economy. This fact has been reflected in the number of green initiatives undertaken by MENA governments, particularly since the mid-2000s.

Figure 11: Number of green initiatives in the GCC, 1995-2019

Since the mid-2000s, regional governments have announced and introduced a series of major initiatives intended to help diversify their economies and tackle the intensifying challenge of climate change. As such, we can discern a trend towards an increase in the number and scope of major sustainable projects. Figure 11 shows that the number of initiatives increased from 11 between 2005-2009, to 18 for the period 2015-2019. This trend has strengthened since 2020 in response to the increase in the frequency and intensity of climate events, the Covid-19 pandemic and COP26. Given that Egypt and the UAE will host COP27 and COP28 respectively, green initiatives will be at the forefront of regional policies at a critical moment in the international community’s response to the climate crisis.

Another discernible trend has been the broadening scope of green initiatives, which started with relatively modest ambition most likely guided by economic rather than environmental factors. For example, in 2008, Abu Dhabi Urban Planning Council launched Estidama with the goal of achieving national sustainability by targeting residential areas and buildings, governmental entities, and commerce. In 2011, Dubai Municipality’s Green Buildings Specifications became mandatory for new government buildings. And in 2012, Sheikh Mohammed bin Rashid al-Maktoum launched Dubai’s Green Initiative. Since 2015, the ambitions of regional states have grown significantly, reflecting the urgency of climate change and their own increasing prominence within the issue on the global stage. For example, in 2021, Qatar Energy launched its new Sustainability Strategy which establishes several targets in line with the goals of the Paris Agreement. The strategy stipulates deploying dedicated Carbon Capture and Storage (CCS) facilities to capture more than 7 million tons per annum (mtpa) of CO2 in Qatar. It sets a clear direction towards reducing the emissions intensity of Qatar’s LNG facilities by 25% and of its upstream facilities by at least 15%; and reducing flare intensity across upstream facilities by more than 75%. Furthermore, it sets out a target to eliminate routine flaring by 2030 and limit fugitive methane emissions along the gas value chain by setting a methane intensity target of 0.2% across all facilities by 2025.

Saudi Arabia in November 2021 announced the Saudi Green Initiative (SGI) and the Middle East Green Initiative. These are pledged to reduce emissions, plant 50 billion trees, and protect the land and sea. For example, the SGI will see the rehabilitation of 40 million hectares of degraded land and increase the percentage of protected areas across the kingdom to more than 30% of the total land area. The first wave of more than 60 initiatives announced under SGI, which was unveiled at the October 2021 Saudi Green Initiative Forum, represent over SAR 700 billion (US$ 186.6) investment to contribute to the growth of the green economy. These initiatives include the following:

A national study is currently underway to develop the masterplan for planting 10 billion trees, which is aimed to contribute to mitigating the impact and risks of climate change by increasing vegetation cover, protecting soil and vegetation from degradation, and improving air quality.

Mangrove Plantation Pilot at Jeddah Islamic Port (JIP) will contribute to cleaning seawater, enriching biodiversity and restoring aquatic life.

Ecological Restoration Pilot in Shaaran Nature Reserve seeks to restore 100 hectares, which will be used to test several approaches to ecological rehabilitation in arid environments.

Green Mosques initiative will plant 30,000 trees across 100 mosques, irrigated with water recycled from ablution.

Planting 45 million agricultural trees in mountain terraces will increase economic return from agriculture by 30%, implement rainwater harvesting to irrigate crops, and create 5,000 job opportunities.

Planting 4 million lemon trees with treated wastewater will contribute to fruit self-sufficiency by up to 45%.

In March 2022, PIF announced that five Saudi businesses (Saudia; Saudi Aramoco; Maaden; Acwa Power and NEOM) would become the first partners of the MENA region’s voluntary carbon market.

The region began establishing sustainable projects in 2006, one of the most notable of which is Masdar City in Abu Dhabi. This comprises a growing clean-tech cluster, business free zone and residential neighbourhood with restaurants, shops and public green spaces. Masdar has invested over $1.7 billion of equity across projects in the city, focusing on mature technologies in solar and wind power, with a total value over $6.4 billion. Elsewhere, Kuwait developed the 20 hectare Al Shaheed park in four successive stages (2013-17), reclaiming and revamping a portion of the former Green Belt, a series of gardens built from 1961-64 between the old city of Kuwait and its expansion. Oman’s first wind-based power project, Dhofar Wind farm – which has generation capacity of 50 MW - commenced commercial operation in 2019. In Saudi Arabia, King Salman Park was launched in 2019 and on completion, it will be the largest urban park in the world, covering an area of 13.3 square kilometres on the grounds of the old airport in Riyadh.

The authors of this report surveyed green infrastructure by project type between the years 2012-2021. We can discern that “green cities” are the overwhelming beneficiary of green infrastructure investments (88.71%). This finding gives a clear indication that new cities such as Masdar City, and green cities under construction such as NEOM, will draw investment and resource away from more established cities intent on greening infrastructure. Figure 12 – which details green infrastructure by type of project - assigns very low values to renewable energy (3.16%), transport (7.34%), water (0.01%), wastewater (0.09%), waste management (0.52%), and green public space (0.15%). These findings reveal the risks associated with concentrating sustainable infrastructure projects primarily in green cities and may be attributed to a surge in more recent projects to green major cities, such as Riyadh, Muscat, Cairo and Kuwait.

Figure 13: GCC and Egypt value of sustainable infrastructure projects, 2012-21 (US$ million)

The findings in Figure 14 reinforce the analyses drawn from Figures 19 and 20. Sovereign wealth funds, in particular PIF, dominate the ownership pattern of sustainable projects in the region. They have secured 83.6%, while the military (5.8%), government agencies (4.3%) and public companies (3.5%) own the remaining projects.

Figure 12: MENA green infrastructure by type of project, 2012-21 (%)

An assessment of the value of sustainable infrastructure projects in the GCC and Egypt between 2012-21 - as shown in Figure 13 - reveals that the committed value increased from a relatively low base of $412m in 2012 to $13.6bn in 2013, $75.464bn in 2015 and peaked at $500bn in 2017. After several fallow years, it increased to $175.28bn in 2021. The peaks signify substantive allocations of funding for Saudi Arabia’s NEOM City ($500bn) and The Line ($150bn), and Egypt’s high-speed electric railway network ($23bn).

Figure 14: GCC and Egypt sustainable infrastructure projects by owner type 2012-21 (%)

KING SALMAN PARK

King Salman Park was launched in March 2019 as part of a $23bn project to create vast, open green spaces in Riyadh that will enable sustainable communities, provide up to 70,000 new jobs and push action against climate change.

Designed by Omrania and managed by the King Salman Park Foundation, it aims to improve quality of life for residents and visitors in line with Saudi Arabia’s Vision 2030 goals of promoting a healthy society. Its design focuses on mixed-use developments, integrating the park with its urban surroundings, and offers a number of sporting, cultural, artistic and recreational facilities. Once complete, it will be the largest urban park in the world – at 5 square miles – boasting 1 million trees and green spaces covering more than 11.6km2. The Park is expected to contribute to increasing vegetation and raising the rate per capita of green spaces, with direct benefits to the environment and climate.

Located on the grounds of the old airport in Riyadh, it is purposefully accessible to the entire city within thirty minutes and will link to five new metro stations and ten bus rapid transit stations; its mobility strategy caters for walking, cycling, autonomous and sustainable modes of public transport.

Construction has commenced with contracts worth $1.02bn recently awarded to a group of national companies to begin implementing parts of the project. With a completion date of 2024-25, it forms part of the broader strategy of ‘greening’ Riyadh enough to lower its ambient temperature by 2°C.

EGYPT – AL MAHSAMA AGRICULTURAL

DRAINAGE TREATMENT, RECYCLING

AND REUSE PLANT

This award-winning $100m water treatment and distribution plant was inaugurated in April 2021. Completed in just one year, it is one of the world’s largest water reclamation plants and will contribute significantly to combating water scarcity in Egypt. Located on the banks of the Suez Canal in Ismailia Governorate, the plant was designed to reverse the declining ecology of the El Temsah Lake – west of the Canal – which has become heavily polluted by run-off from farming. With capacity to treat up to 1m cubic metres of water per day – mainly agricultural drainage - the plant has been constructed vertically to make maximum use of space. The treated water will irrigate 70,000 acres of land in central Sinai and will also be used in land reclamation projects.

The plant forms an integral part of Cairo’s strategy to develop the Sinai region through creating sustainable urban communities and job opportunities, as well as developing farmland. The project is owned by the Egyptian government and its Engineering Authority for the Egyptian Armed Forces, designed and managed by Khatib & Alami, and constructed by Metito Overseas Limited and Hassan Allam Holding.