Public sentiment polling data drawn from 12 MENA countries highlights regional attitudes to inflation, energy volatility, and physical security.

INTRODUCTION

Middle East and North Africa (MENA) countries face a multitude of challenges in 2023 that enhance the need for collective action and greater cooperation. The substantial windfall from oil and gas revenue due to the war in Ukraine presents an exceptional opportunity to invest in the region’s future as global financial conditions become increasingly squeezed. The International Monetary Fund (IMF) estimates the region’s oil and gas exporters will realize additional cumulative oil revenues of $1.3 trillion over the next four years. These significant resources can be invested to accelerate the region’s economic transformation, strengthen resilience in the face of future shocks, generate prosperity, and advance overall development.

The year 2022 witnessed a newfound regional dynamic driven primarily by private sector investments and active diplomacy. Think Research and Advisory expects this dynamic to accelerate in 2023 as more capital is invested in the region and barriers to economic opportunities are removed, and as MENA countries take on a larger, more active role in global affairs.

At the tail-end end of 2022, Think Research & Advisory commissioned a survey across 12 regional countries aimed at measuring public expectations for the coming year. The survey found that while MENA populations generally expect to spend more on food, fuel, and electricity, they also broadly expect their sense of physical security to improve over the next 12 months.

1. A NEWFOUND REGIONAL DYNAMIC

Regional governments displayed newfound confidence in 2022. This was driven in part by high oil prices and the return of energy security to the global agenda, but also by a growing belief in the region that MENA has come to occupy a pivotal role in global affairs. This confidence gave rise to policies supportive of the region, such as the Middle East Green Initiative, as governments increasingly asserted their national and regional interests.

The new dynamic played out on the world stage, as Europe grappled with the challenge of sourcing new oil supplies amid OPEC+ production cuts. It also took place as Egypt hosted the COP27 Climate Change Conference, ahead of the UAE’s hosting of the gathering in late 2023. During COP27, the Arab Coordination Group announced $10 billion in funds to address the global food security crisis, mitigate the effects of climate change, and strengthen climate resilience. Further, Qatar’s successful hosting of the World Cup not only captured Arab sentiment the world over, but it also demonstrated to other regions of the world that they too could step forward and host international tournaments. In 2022, the Middle East made a clear statement of intent about its togetherness and global reach.

As MENA braces for continued challenges in 2023, there is a growing sentiment that regional countries can work together to secure economic and social stability for the benefit of all countries and citizens. This goal is not new, but as dynamic young leaders take the stage in the region, it has renewed relevance. Achieving regional self-reliance and strengthening resilience are critical first steps towards managing complex shifts in the distribution of global power – as well as shoring up regional stability at a time of global economic uncertainty.

Key takeaway: Intraregional relations are expected to advance positively in the areas of energy, technology, climate, economics, and security. Resource-rich Gulf Cooperation Council (GCC) countries , led by Saudi Arabia and the UAE, will continue to invest nationally and regionally, drawing on lessons learned from previous oil booms. It is expected that new investments will be better placed to support diversification and economic transformation, thereby enhancing economic resilience and advancing prosperity.

2. GCC TO TAKE PROACTIVE ROLE IN GLOBAL AFFAIRS, BALANCE GREAT POWER TENSIONS

GCC countries have taken a nuanced approach to Russia’s invasion of Ukraine – balancing the interests and objectives of the U.S., China and Russia – but crucially, leveraging their relationships with each to make the region a pivotal player in the shifting global geopolitical landscape. All GCC countries voted in favour of a UN General Assembly resolution in March 2022 demanding Russia withdraw its forces from Ukraine. The GCC has also pursued a series of soft power initiatives supplementing this position.

The U.S., China and Russia will continue to play important, distinct roles in the region, regardless of the tensions between themselves. The U.S. will remain a primary security partner, but is moving towards regional capacity-building with an increased reliance on technology as it draws down its physical military presence. China will not seek to fulfill any strategic security gap that emerges from Washington’s shift, with Beijing focusing instead on enhancing economic ties—demonstrated by President Xi Jinping’s visit to Saudi Arabia in late 2022. For its part, Russia will continue to pursue bilateral ties with GCC countries given the significance of oil to their respective economies. Moscow will also remain engaged in Syria and across North Africa, important theatres for the broader region’s security and economic stability.

GCC countries’ ability to sit across the widening political chasm post-Russia’s invasion of Ukraine has led to greater diplomatic involvement on the international stage. Qatar played the role of mediator during the 2021 U.S. withdrawal from Afghanistan, and this trend has continued with Saudi Arabia’s instrumental part in negotiating the release of British hostages from Ukraine in 2022. The Kingdom, alongside the UAE, also coordinated a prisoner exchange that saw American basketball star Brittany Griner return home from Russia before Christmas.

The Gulf region has also become increasingly active in creative foreign policy arenas: sports and cultural diplomacy; knowledge exchanges; investment; and skills and technology transfers across key and developing sectors in their economic diversification programmes. This is a trend that is likely to continue.

Key takeaway: 2023 will see GCC countries combine their balanced, pragmatic, and creative approach to foreign policy with a more proactive diplomatic presence in global affairs. Despite, or because of, the growing multipolarity in international geopolitics, Gulf countries will continue to carve out an integral role for themselves as key interlocutors between the U.S., China, and Russia. The region more broadly will build on its major soft power successes in 2022 to raise its profile as a centre for innovation, forward thinking, and social entrepreneurialism.

3. ECONOMIC OUTLOOK STRONG FOR ENERGY-RICH STATES, CHALLENGING FOR EMERGING COUNTRIES

Economic activity in MENA countries remained generally strong in 2022, but international developments and worsening global economic and financial conditions had varying impacts on the region’s economies. Windfall oil and gas revenue due to Russia’s war in Ukraine resulted in large external and fiscal surpluses, allowing energy-rich countries to expand investments in non-hydrocarbon activities, launch ambitious state-driven development plans, and register robust growth while containing inflation. However, rising commodity prices intensified food security concerns in the region’s emerging economies given their high dependence on energy and food imports. Soaring prices resulted in higher living costs and weakened purchasing power, with inflation reaching double digit levels and governments increasing social spending to maintain social stability.

The projected slowdown in the world economy, broadening inflation and high interest rates, together with a prolonged energy crisis and significantly tighter global financial conditions, are expected to pose momentous challenges for MENA countries in 2023, including a deceleration in the region’s overall economic activity. Prospects are, however, mixed. Energy-rich countries will continue to benefit from considerable oil and gas revenues in 2023. Policymakers will need to maintain momentum on pro-business and economic modernization reforms and ensure that financial resources are invested to expand non-hydrocarbon economic activities. The region’s emerging economies will need to navigate an increasingly complex environment. Policymakers will have to control inflation, ensure food security and protect the vulnerable, while sustaining growth and maintaining macroeconomic stability. High interest rates and squeezed financial conditions will increase debt service costs and tighten access to international financial markets, adding pressure to already-strained budgets and financial stability. Meanwhile, the region’s fragile low-income countries will continue to rely on foreign aid and humanitarian assistance to secure basic needs.

There are some bright spots for the region’s economies in 2023. Travel and tourism are expected to fully recover, providing a needed boost for countries such as Egypt and Jordan. Moreover, energy-rich countries are pledging large financial investments in MENA’s emerging economies.

Key takeaway: Energy-rich countries in the region will continue to benefit from surplus revenue, offering them the opportunity to spearhead diversification through investments and continued economic modernization programs. For the region’s emerging economies, 2023 will pose numerous economic and financial challenges that could heighten their reliance on regional and international support and further underscore the need to address long-standing structural issues.

4. CLIMATE COOPERATION SET TO INCREASE AS GLOBAL WARMING BITES

MENA countries are experiencing the impact of climate change, with water increasingly scarce and frequent irregularities in weather patterns. Flash floods are recurrent in the Gulf, and high-intensity sandstorms are more frequent across the region, particularly in Iraq. According to the World Bank, sandstorms create annual losses of $13 billion across the region.

The region is the most water-scarce in the world, with access getting worse by the day. Water scarcity in fragile countries such as Yemen, has exacerbated conflicts and led to the emergence of water disputes. Due to Yemen’s geographic position, instability could spill out further into the region and threaten the security of the Bab Al Mandab strait. Despite the high stakes, the MENA region is one of the smallest recipients of climate financing globally.

MENA’s acute climate challenges have led to increased regional pledges and initiatives. Saudi Arabia’s Middle East Green Initiative, along with Iran-GCC and Iran-Iraq sandstorm diplomacy, and Egypt and the UAE’s hosting of COP27 and COP28 are some examples, as Middle East countries help lead the global change to a renewable and low-carbon driven energy future.

Key takeaway: Climate security has emerged as a major threat to economic, national and regional security in the MENA region. Regional cooperation to address climate concerns will increase in 2023. Climate finance initiatives are set to grow, while the region’s hosting of COP27 and COP28 will further galvanize public and private sector funds. While environmental security will help catalyse wider regional cooperation, progress could be impeded by competing interests on hard-line security issues.

5. OIL VOLATILITY EXPECTED TO CONTINUE AND ENERGY SYSTEM TO BIFURCATE

Oil prices soared in 2022, driven by Russia’s invasion of Ukraine, the global economic rebound after COVID-19, supply chain disruptions, and continued underinvestment in the hydrocarbon sector. These factors will continue to shape the oil market in 2023, but global macro-economic uncertainties will increase oil price volatility.

The outlook for global oil demand is uncertain, given that indicators point to stalled global growth. Economic headwinds will tighten global monetary policy, while high inflation will slow economic activity and dampen oil demand. As such, oil prices will swing in 2023, causing consternation for policymakers and creating economic hardship in low-income populations.

In 2022, developed economies were compelled to reconsider hydrocarbons’ contribution to their short- and medium-term energy mix. Nevertheless, oil price volatility in 2023 will hasten North America and Europe’s bid to transition away from hydrocarbons and reduce their dependency on oil and gas markets. There is a clear economic, environmental and political imperative for reducing this dependency, especially given Europe’s move away from Russian oil and gas. However, at COP27, oil producing countries reaffirmed hydrocarbons’ centrality to the future global energy mix – albeit at lower levels – while making a clear commitment to increase hydrocarbon production capacity.

2023 will be a pivotal year as the global energy system begins to bifurcate between hydrocarbon-based countries and energy economies based on renewable and low-carbon energy sources. Oil producers are betting that oil will remain in the global energy mix for longer and that prices will remain high in 2023, enabling their domestic diversification. This is driven by many factors despite the uncertainties. The oil industry’s underinvestment hinders its ability to meet any significant rebound in demand. Additionally, geopolitical risks around the Arab Gulf amid heightened tensions between Iran and its regional and global adversaries could create upward volatility in oil prices as maritime and energy security is threatened.

Key takeaway: Oil prices will remain volatile in 2023, giving rise to challenges for all policymakers. However, we expect energy-rich countries will continue to enjoy the benefits of an oil windfall. This will allow hydrocarbon producers to leverage their revenue surpluses to drive domestic investments alongside economic growth and diversification. The windfall will also strengthen Gulf countries’ position in the global economy. However, a bifurcation of the global energy market between hydrocarbon producers and energy economies driven by renewable and low-carbon energy is occurring, which will cause shifts in global trading alliances.

6. IRAN’S DESTABILIZING ACTIVITIES TO CONTINUE AS GCC AND ALLIES BOOST SECURITY COOPERATION

The failure to revive the Joint Comprehensive Plan of Action (JCPOA), or the “Iran nuclear deal”, in 2022 has brought the Islamic Republic of Iran (IRI) closer to becoming a threshold nuclear state. As the U.S. continues to shift its attention towards China and increases focus on Russia, MENA will build on its own nascent efforts to counter Iranian influence and destabilizing activity through regional mechanisms, such as the GCC+3, as well as through new international partnerships.

Baghdad will continue to play a key role in mediating bilateral talks between Saudi Arabia and Iran, although progress will be limited; de-escalation will remain the primary objective, given that the Kingdom, and the wider region, would be the most likely target of any Iranian attack. Separately, the France-backed Baghdad mediation process will also pursue de-escalation with Iran, as opposed to efforts to counter Iranian influence.

In parallel, Russia’s use of Iranian materiel in its war against Ukraine has heightened the global perception of the Iranian threat, particularly in Europe. Regional countries such as Saudi Arabia and the UAE will therefore enhance their security and defense engagement with players such as the UK and the EU – for whom the Iranian threat now feels much closer to home.

Meanwhile, widespread protests across Iran have captured the attention of governments and publics around the world. International support – at least vocally – for the protestors will encourage Tehran to both repress domestic uprisings and demonstrate its resolve. It will capitalise on the international community’s focus on Ukraine to reassert itself through its proxy forces in Syria, Yemen, Gaza and Lebanon.

Key Takeaway: Iran is likely to intensify its destabilising activities in 2023. Regional countries will work together with global allies to prevent Iranian attacks in key maritime arenas such as the Bab Al Mandab strait and the Strait of Hormuz to minimize risk to energy markets. Iran’s persistence in causing instability in the region will result in its continued isolation from the international community and yet the regime will not seek to change course. Moreover, faced with protests and widespread discontent across the country, the Iranian government is under pressure but will continue to bear down on protestors as a means to assert its authority.

POPULATION OUTLOOK FOR 2023: A SURVEY

Think Research and Advisory commissioned a survey across twelve MENA countries to uncover public sentiment and expectations for the coming year.1 Think’s aim was to measure changes in perceived expectations over three key areas: inflation, energy volatility and physical security.

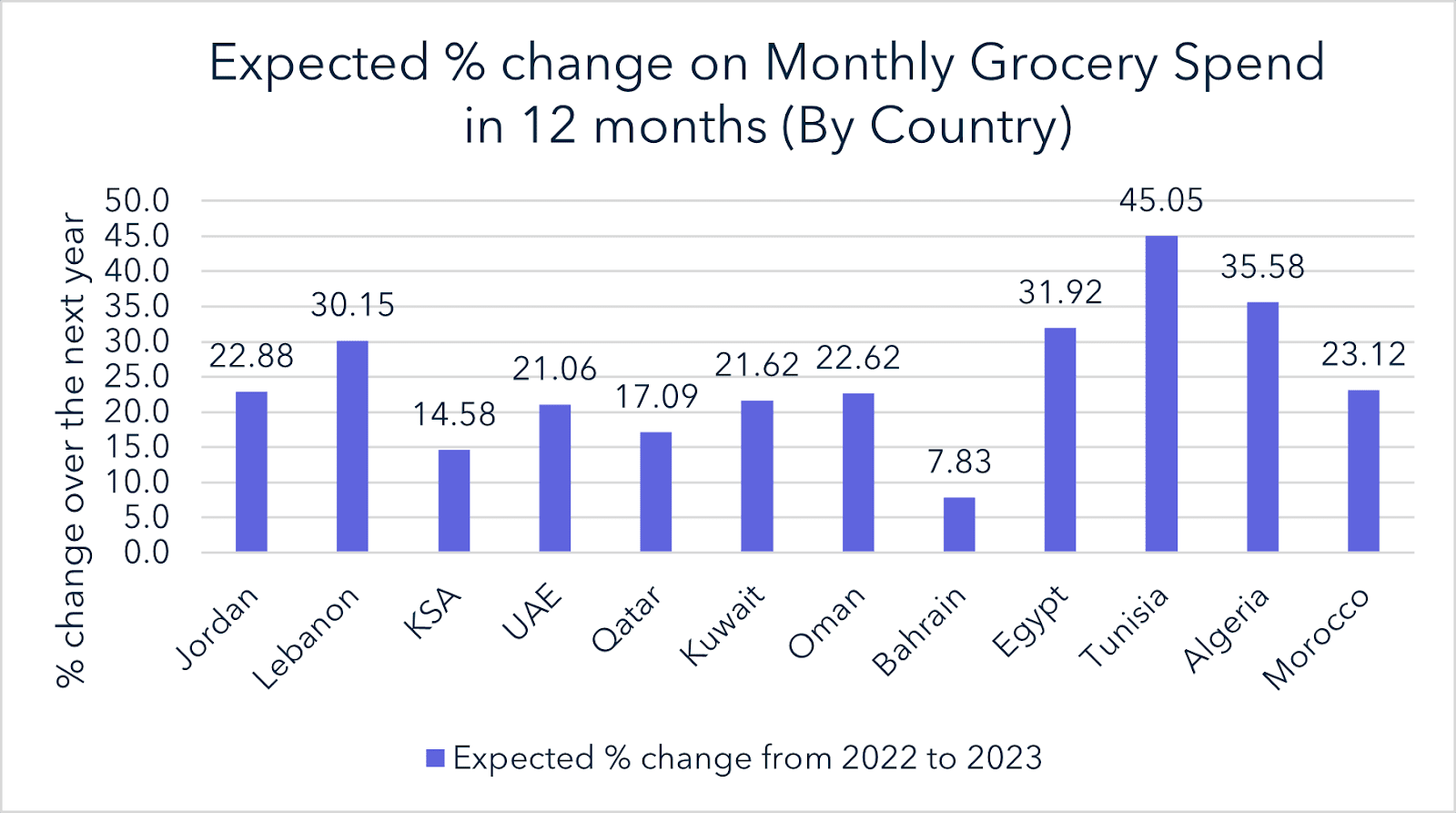

Expected grocery spending

Findings show that populations region-wide expect to spend more on groceries over the coming year. Respondents in North Africa expect on average to spend $175 more on their monthly grocery bill 12 months from now, an increase of nearly 32% from 2022 to 2023. This compares to a 26% increase expected by the population surveyed in the Levant region, and a 17% increase expected by GCC residents.

Expected sense of physical security

All countries surveyed expect their sense of physical security to improve over the next 12 months. The populations of the Levant and North Africa regions were most optimistic about their security improving this year, with 10% and 7% expected increases, respectively. The countries that had the largest percent changes in their expected sense of physical security over the next year are Algeria, Lebanon and Morocco (13.53%, 13.33%, 10.65% increases respectively).

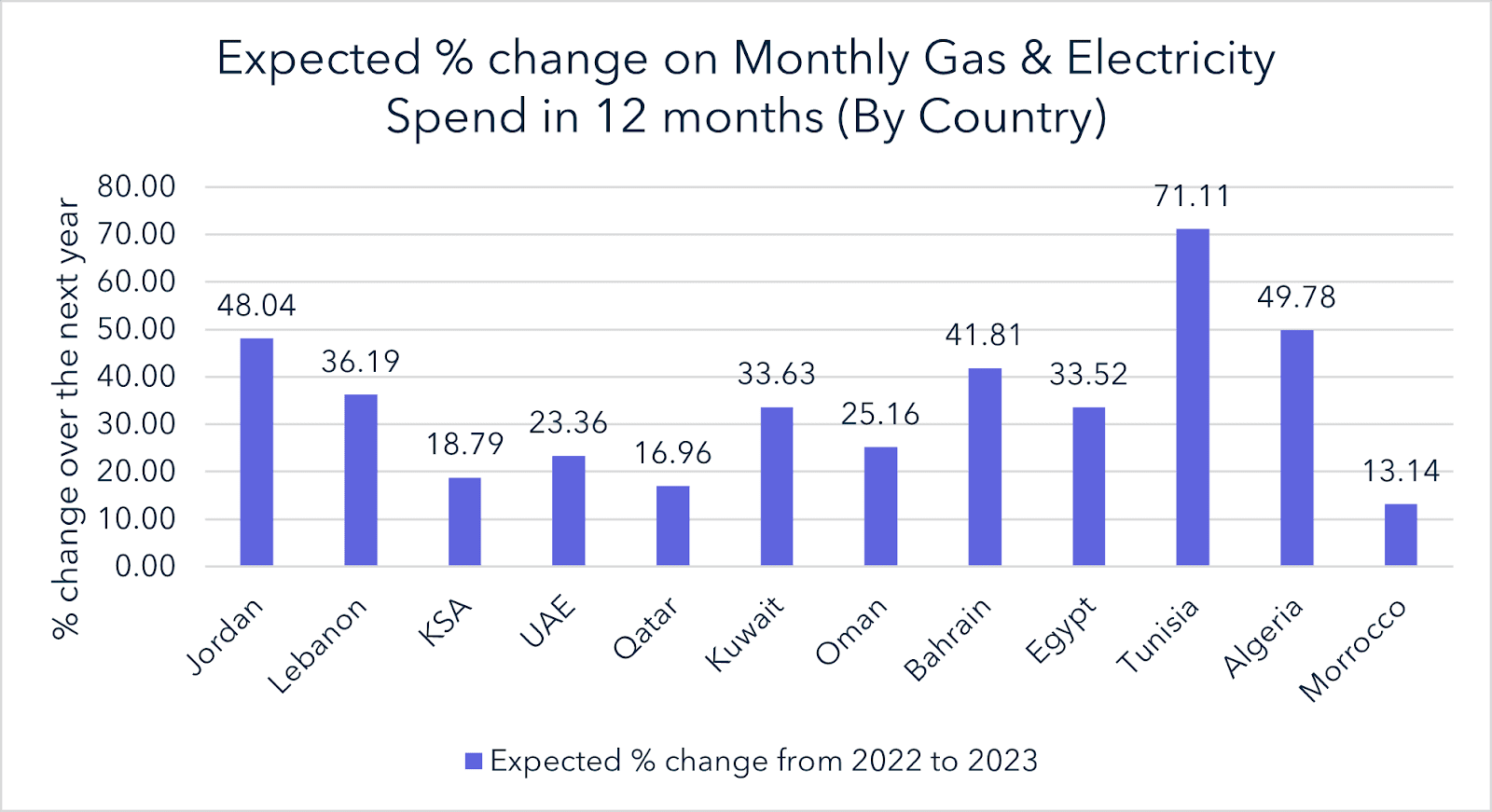

Expected gas and electricity expenditure

Respondents in the Levant region expect to spend on average $83 more on their monthly gas and electricity bill 12 months from now, an increase of nearly 41.23% from 2022 to 2023. This compares to a 39.24% increase expected by respondents in North Africa, and a 23.52% increase expected by GCC residents.

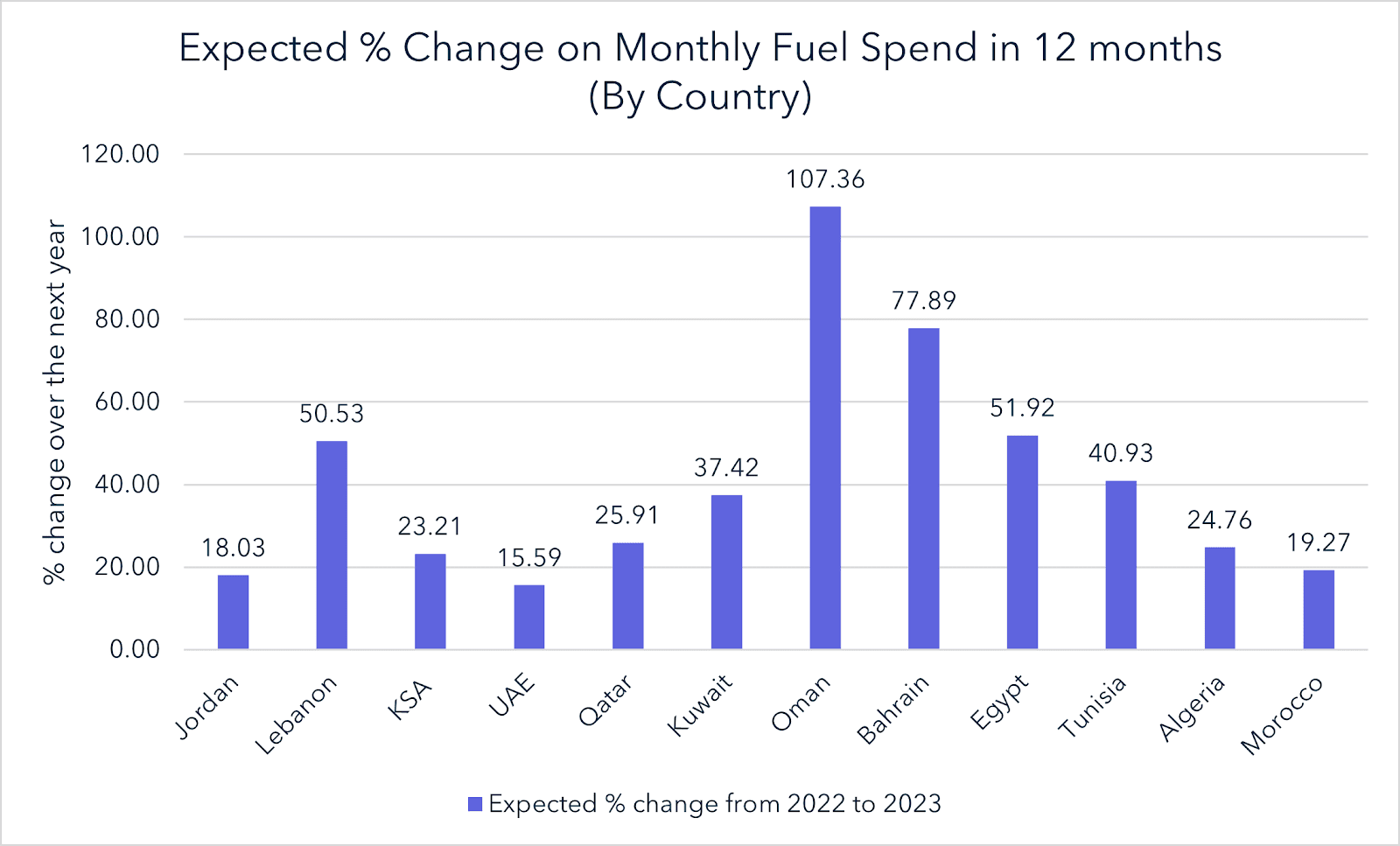

Expected fuel spending

Respondents in North Africa expect to spend on average $83 more on their monthly fuel expenses 12 months from now, an increase of nearly 36.27% from 2022 to 2023. This compares to a 34.79% increase expected by the population surveyed in the Levant region, and a 31.26% increase expected by GCC residents.

1Based on a survey commissioned by Think Research and Advisory in the MENA* region over a sample of 1600 respondents** surveyed online in December 2022.

*Countries surveyed: Lebanon, Jordan, Saudi Arabia, Qatar, Kuwait, UAE, Oman, Bahrain, Egypt, Tunisia, Algeria, Morocco

**Sample audience representative of internet consuming population