The Middle East and North Africa region is one of the lowest recipients of climate finance compared to other areas of the globe, such as East Asia and the Pacific Islands, despite MENA’s exposure to extreme climate risks. The MENA region’s share of climate financing from the big three global climate funds — the Green Climate Fund (GCF), the Climate Investment Funds (CIF), and the Global Environment Facility (GEF) — and their sub-funds made up only 6.6% of their cumulative global financing through 2023. Accounting for co-financing mobilized through these funds, the MENA region received a cumulative total of $24.4 billion between 1992 and 2023, among the lowest share globally, according to a study by SRMG Think (where the authors serve as the head of energy transition and the head of the geopolitics practice). If MENA countries are to succeed in their net zero and climate mitigation and adaptation efforts, then the approved financing from global climate funds must be boosted significantly. Moreover, financing needs to be distributed more widely across the region, as it is currently concentrated on just a few countries, mainly Morocco and Egypt. Applicant countries face many challenges in applying for project financing, and “minding the gap” requires simplification, regionalization, and innovation in climate finance.

Mobilizing finance is the key catalyst for climate action, but funding has fallen chronically short of meeting the global climate challenge. At the heart of this financing is capital disbursed from the trio of major international climate funds listed above. The GCF, CIF, and GEF are critical to developing countries that struggle to attract finance, as securing these funds helps mobilize private-sector and multilateral development bank (MDB) financing. The following analysis considers exclusively this subset of climate funding and not private capital or all other sources of climate finance.

Simply not enough

While all categorized as “developing,” countries in the MENA region are economically diverse and range from high-income oil exporters to conflict-affected and least-developed states. A country’s income level impacts not only its political will to apply for climate funds but also its capacity to do so. SRMG Think’s aforementioned study assessed the funding approved by the three major global climate funds and their sub-funds for 19 countries across MENA, based on data collected on over 350 projects from the public domain. In the case of multi-country projects where an exact breakdown per country was unavailable, the data was adjusted to an estimate.

The need to revamp the climate finance system and push for new and creative financing mechanisms were major themes last year at the United Nations Climate Change Conference (28th Conference of the Parties, COP28), in Dubai. The first Global Stocktake — a process that evaluates progress and identifies gaps in the world’s approaches to addressing climate change — concluded the event, highlighting an increasing mismatch between the needs of developing countries and the support available to them. It referenced the need to unlock and deploy trillions of dollars “towards climate action and climate resilient development.”

At COP28, governments pledged to provide additional funding to the GCF (the total pledges now reach $12.8 billion from 31 countries) and two GEF-managed funds, the Least Developed Countries Fund and the Special Climate Change Fund. Pledges of approximately $188 million were also made to the Adaptation Fund. The GCF is the biggest climate fund in the world and MENA’s largest contributor from among them, although less than 8% of the fund’s total approved financing of $12.7 billion has gone to MENA to date.

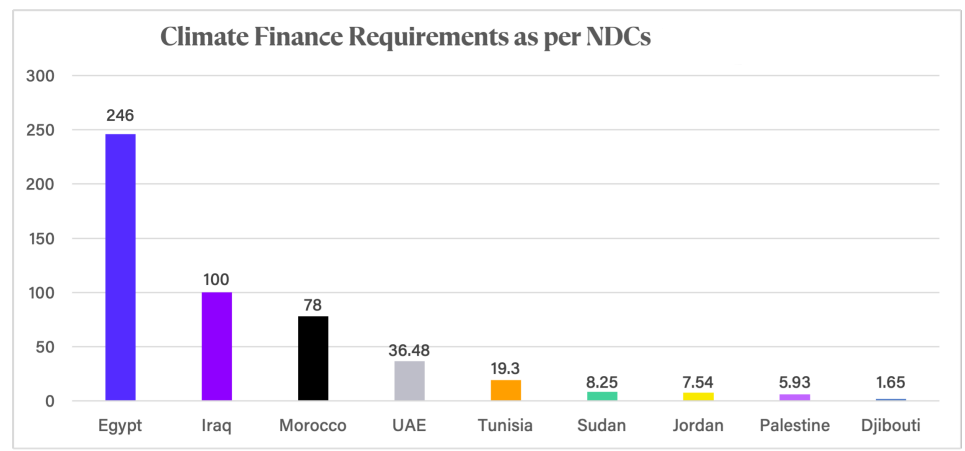

The first Global Stocktake demonstrated that global pledges had fallen far short of the required financing to help developing countries implement their Nationally Determined Contributions (NDC) and adequately develop and roll out adaptation and mitigation measures — the cost of which amounts to trillions of dollars annually. As a case in point, MENA’s financing from climate funds is 20 times lower than the requirements of the nine regional countries (Egypt, Tunisia, Morocco, Jordan, the United Arab Emirates, Iraq, Djibouti, Palestine, and Sudan) that have quantified their climate response costs in their NDCs, equivalent to $495 billion. Of this, Egypt and Iraq account for 67%. The remaining MENA countries have not yet communicated to the UN Framework Convention on Climate Change (UNFCCC) their required financing, so the total needed across the region will in fact be exponentially higher.

Figure 1: Climate finance requirements as per NDCs (billion $)

Source: SRMG Think

Figure 2: Financing from applied for and approved by climate funds for countries that have costed their finance requirements in NDCs (million $)

Source: SRMG Think

Insufficient and uneven: The state of climate funding in MENA

The climate financing approved by the aforementioned climate funds in MENA so far is heavily concentrated on a few countries, and more than half of the approved funding takes the form of loans, adding pressure to the region’s overall debt issues. A significant portion of the funding approved for MENA by the three major global climate funds is predominantly allocated to Morocco, Egypt, Tunisia, and Jordan, accounting for 86% of the region’s approved climate funding. North African countries account for 78% of all climate funds approved for projects in MENA. Sixty percent of the cumulative funding is earmarked for Morocco and Egypt.

At the same time, however, capabilities to apply and receive approval for climate funds are not yet adequately developed in most countries, leading to marked inequality between climate funding recipients within the region. Countries that have laid out national strategies — including investment plans — built institutional capacity; and those that have engaged with funds and co-financing facilities are more likely to be approved for projects financed by global climate funds. These countries can build a track record with climate funding institutions, positioning them in good stead to access further financing, specifically for clean energy and clean technology-related initiatives.

Energy projects command the lion's share of approved climate funds in MENA. The Clean Technology Fund (CTF), a subsidiary of the CIF focusing on clean energy technologies, stands as one of the region’s most substantial climate financiers. Moreover, 58% of GCF-approved funding in MENA is allocated to energy projects. Countries like Morocco and Egypt, which prioritize renewable energy deployment, have particularly benefited from this inflow to their energy projects.

In contrast, least-developed countries and those affected by conflict and political instability continue to struggle, not only with the immediate impacts of climate change and its risks as a threat multiplier but also to meet global climate funds’ criteria. This severely limits their ability to access climate financing, leaving them not only underfunded but also underprepared.

The process is extensive, averaging 4-5 years to go from application to approval within the GEF and GCF systems. This increases evolving risks and costs associated with projects; and given the processes’ complexity, it typically requires financial or technical assistance to complete applications. All this limits the efficacy and impact of the funding.

Countries that have managed to navigate this, such as Morocco and Egypt, have built a proven record of successfully applying for, receiving, and executing project financing from global climate funds, which has proven to be an asset in securing subsequent funding. These countries are well positioned to develop further investment plans, draft funding proposals, interact effectively with various agencies, and achieve the identified key performance indicators. Hence, MENA recipients of the highest levels of financing are those that have accessed multiple sources of finance.

Conversely, least-developed and conflict-affected countries like Yemen, Iraq, Syria, Sudan, and Libya have only accessed funding from one of the funds, specifically the GEF, which provides lower-ticket-size projects compared to the other major funds. The lack of track records among these countries is hindering progress on adaptation and mitigation measures. The challenges linked to limited technical and financial capacity, along with political instability in these countries, further exacerbate their situation. Additionally, they struggle to meet eligibility criteria for global climate financing due to a low prioritization of climate action, inadequate institutional capacity, slow engagement with UNFCCC processes, data collection difficulties, and unsafe security environments.

Flipping the script

Discussions at COP28 centered on the need to scale up and set a “new collective goal on climate finance in 2024.” Therefore, climate finance will be the major theme of COP29. Increasing access to global climate funds is a key priority. Addressing barriers to access is crucial for developing countries, particularly those in MENA, to implement effective climate responses. Achieving this will require a three-step action plan that simplifies the process for recipients, regionalizes the focus of the funding, and develops innovative, new funding mechanisms. International donors, stakeholders, fund managers, and aid aspirants must work together to:

1. Simplify the process

Simplify the application process to enable countries with varying degrees of institutional capacity to access climate funding within a more reasonable timeframe, thereby reducing resources spent and increasing the efficacy and relevance of funded projects. Streamline the terminology and definitions used by global climate funds to avoid applicants facing unclear, contradictory, or confusing criteria. Increase transparency around the data associated with funding allocations, applications, approvals, and disbursements, and establish a clear set of success metrics whereby projects funded by global climate funds can be evaluated.

2. Regionalize the focus

Explore the viability and efficacy of a regionally led climate fund focused on region-specific climate issues. The MENA region includes multiple conflict-affected or fragile countries that require specialized and innovative funding solutions to enable progress on climate objectives — particularly in the absence of national capacity or will. One means of achieving this could be to increase funding for local action on implementing mitigation and adaptation measures at a community level.

3. Establish innovative financing mechanisms

Capitalize on linkages between humanitarian aid, climate financing application, and distribution mechanisms to avoid a duplication of effort in terms of both the bureaucratic process and in addressing the cause and effect of climate change. Secondly, explore the availability and use of philanthropic capital in climate financing, moving away from the mindset that climate financing must operate in the same way as traditional investments.

Conclusion

The MENA region faces some of the most severe impacts of climate change, yet its ability to attract much-needed climate financing is not necessarily determined by levels of vulnerability and need. Instead, success or failure is determined by each country’s institutional and financing capacity to apply for and navigate the financing processes as well as its experience in engaging with multiple funds and co-financing processes. This has led to marked inequality across the region. Unless the current climate financing system is reevaluated and streamlined, this inequality will only continue, to the detriment of the most at-risk countries. The expected impact of climate change on the MENA region will be great — as will the impact of low levels of financing to combat it.

Jessica Obeid is head of energy transition at SRMG Think. She is also a Non-Resident Scholar with MEI’s Lebanon and Economics and Energy programs.

Alice Gower heads the geopolitics practice at SRMG Think.

Photo by FADEL SENNA/AFP via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.